Identifying the Hidden Talent

We have big shot companies who are operating in various fields and have a well established name. It's products have high demand and people have full trust and faith on their products. Let's have a look at these companies:

- Dabur

- Patanjali

Let's have a look at the details of these companies:

- DABUR- Dabur India Ltd. is one of the leading FMCG companies in India with revenue of over Rs.7,680 crore and market capitalization of over Rs.48,800 crore. Dabur is the world's largest Ayurvedic and Natural Health Care Company with a portfolio of over 250 Herbal and Ayurvedic products. Dabur also recommends various Ayurvedic Home Remedies formulated using ayurvedic plants and herbs which are natural and chemical free. Dabur has two divisions in India: consumer care division and foods division apart from its international operations.

The second division, Dabur Foods Ltd produces fruit juices, cooking pastes, sauces, and items for institutional food purchases. Dabur is well placed among its consumer goods peers because of its positioning as an Indian company whose products are derived from exotic sources such as ancient ayurvedic texts and natural ingredients such as herbs. Its FMCG portfolio includes five flagship brands with distinct identities- Dabur as the master brand for natural healthcare products.

The ayurvedic company has a wide distribution network, covering six million retail outlets with a high penetration in both urban and rural markets. Dabur's products also have huge presence i the overseas markets and are today available in over 120 countries across the globe. Its globe are highly popular in the Middle East, SAARC countries, Africa, US, Europe and Russia. Dabur's overseas revenue today accounts for over 30% of the total turnover.

Now let's turn our eyes on our second company:

2. Patanjali- Patanjali Ayurved Limited is an Indian consumer goods company, manufacturing units goods company, manufacturing units and headquarters are located in the Industrial area of Haridwar, Uttarakhand while the registered office is located at Delhi. The company manufactures mineral and herbal products. According to CLSA and HSBC, Patanjali is the fastest growing FMCG company in India. It is valued at Rs.3000 crore and some predict revenues of Rs.5000 Crore for the fiscal year 2015-16. Patanjali declared its annual turnover of the year 2016-17 to be estimated Rs.10,216 Crore. It was listed 13th in the list of India's most trusted brands as of 2018, and ranks first in FMCG category. Its products are foods, beverages, cleaning agents, personal care products, ayurvedic medicine and fashion. Its revenue was Rs.9500 crores in 2018.

Patanjali Ayurved sells through nearly 4,700 retail outlets as of May 2016. Patanjali also sells its products online and is planning to open outlets at railway stations and airports. Patanjali Ayurveda has tied up with Pittie Group and Kishore Biyani's Future Group on 9 October 2015. As per the tie-up with Future Group, all the consumer products of Patanjali will be available for the direct sale in Future Group outlets. Patanjali Ayurveda products are also available in modern trade stores including Reliance retail, Hyper city and Star Bazaar apart from online channels. Patanjali Ayurved, co-founded by Yoga-Guru Ramdev, is targeting Rs.10,000 crore revenue in 2016-17, after sales grew 150% in the previous financial year to Rs.5000 crore.

Patanjali Ayurved has also started its FMCG expansion in form expansion in form of dealership and distributorship channels across the country and expects wider growth in overseas distribution as well.

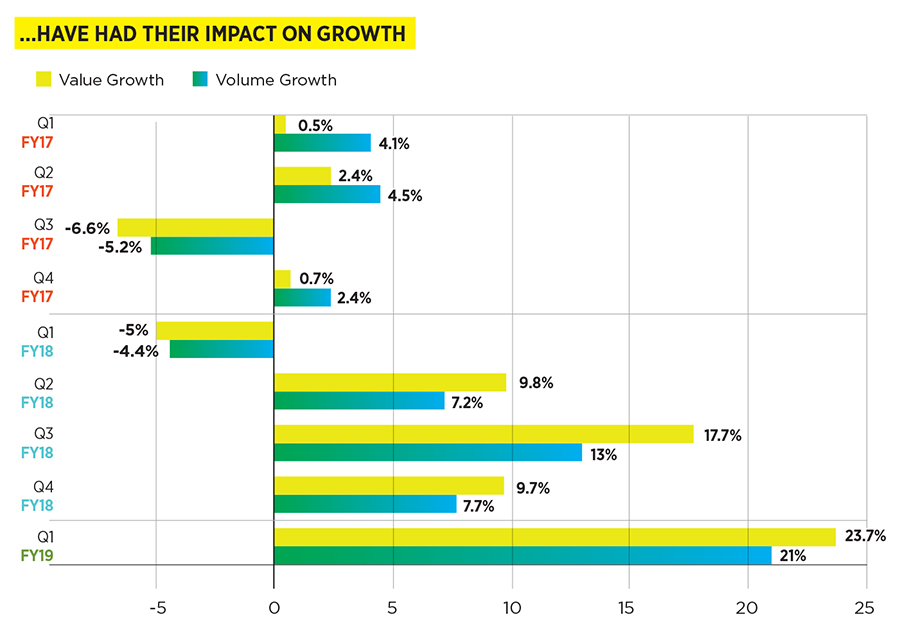

FMCG company Dabur has said that the competition from Baba Ramdev's rival Patanjali Ayurveda has slackened. Releasing its quarterly results, Dabur said that the competitive intensity of Patanjali has abated, CNBC TV-18 reported. However the company still continues to face the headwinds of demand slowdown and expects the situation to persist for a while.

While Patanjali brought stiff competition to both global and desi fast-moving consumer goods companies with its Ayurveda and swadeshi pitch in 2009, the Haridwar based company has not launched new products in quite some time now. However, Patanjali Ayurveda recently said that it looks to replace current market leader HUL as the biggest FMCG company in India in the coming years, PTI reported. Patanjali is also eyeing a turnover of Rs.35,000-Rs.40,000 crore by the next financial year, Yoga Guru Ramdev said earlier this week. By comparison, HUL had posted revenues of Rs.38,224 crore in FY19.

It took Dabur five quarters- a good 15 months-to realize that Ayurveda hinged on 'faith' was getting the better of the one based on 'science'. Patanjali, an ayurvedic upstart backed by maverick yoga Guru Ramdev, had disrupted the fast-moving consumer goods (FMCG) market in early 2015. The bunch that first felt the heat were the multinational giants (MNCs) led by Hindustan Unilever and Colgate, who were vilified by Ramdev as a 'foreign evil' exploiting the country.

Amit Burman, vice chairman of Dabur, asserts that Dabur's Ayurveda is based on science and not faith. "We have a lineage going back 130 years, which nobody can claim," he says. During the last fiscal, 620 health camps were organized across the country, where Ayurvedic practitioners treated close to a lakh patients. Over 250 doctor meets were organized to showcase the core principles of Ayurveda involved in processing and manufacturing Ayurvedic medicines.

The combative avatar of Dabur comes at a time when Ramdev is believed to have assembled an over 10,000 strong sales field force to fan out in rural India. As Patanjali starts losing steam in cities-bogged down by quality perceptions and spreading itself too thin into areas such as dairy and agri-the next wave of growth is likely to come from the hinterland. Dabur, which gets 46% of its sales from rural India, is ready for that challenge.

Debuting in 2009, Patanjali Ayurved disrupted the FMCG industry with its ardent Ayurved and Swadeshi pitch. It had flooded the market with toothpaste, hair oils, ghee, biscuits, flour, pulses and more. Cashing in on Ramdev's popularity, Patanjali hit the Rs.100 billion revenue mark by 2017, becoming the first-ever FMCG brand to reach this figure within a decade of its launch. Patanjali Ayurved, however could not sustain its success, tripped by reckless expansion and diversification, quality issues and resurgent rivals.

"They expanded too fast without consolidation and entered far too many categories (such as SIM cards and solar panels) instead of growing their core brands, "said Amit Adarkar, India CEO of Paris-based market research firm Ipsos. "Quick expansion also led to quality issues with products eroding consumer trust in Patanjali brand. With over 2,500 products, the company sub-contracted production to third party suppliers, which made it difficult for it to keep tabs on quality standards."

"Patanjali Ayurved has been focusing on growing its existing big brands rather than announcing multiple launches. This single-minded focus has helped the company make gains by having better control over product quality," said Chandramouli. It has also been working on its distribution network. "Patanjali Ayurved is now moving away from company-branded stores to mom and pop stores. This transition takes time but will eventually help it reach more customers, "according to Trakroo.

For the past two decades, every time the management of Dabur India Ltd met to finalize a new product, it ended up also debating whether to stick to Ayurveda or to focus on non-Ayurvedic products. Ayurveda cannot take Dabur far, the Burmans were convinced. So, the family that popularized Ayurveda in India moved away from its core strength. The Burmans realized that Dabur needs to get back to basics and return to its core. The Burmans wanted to build an empire outside India-across the Middle East, Africa, Europe, North America and South Asia, which together accounts for 32% of Dabur's consolidated sales at present. Across all these countries, Ayurveda was never a popular or saleable concept. So the shift was only natural.

A couple of months ago, the company revamped its marketing communications with a new tagline-Science-based Ayurveda. So far, it was "celebrate life". "All our advertisements and other communication are now based on one theme-Science of Ayurveda. "We have been marrying the age-old Ayurvedic heritage and traditions with cutting-edge scientific prowess. We have a strong in-house research wing that follows a 'bush-to-brand' approach. We have our in-house nursery, which grows several rate herbs that go into various products. Dabur is probably the only company which is involved in both classical or ethical as well as OTC (over-the-counter) formulation research for close to 40 years now, "says J.L.N. Sastry, head (research and development, Ayurveda) at Dabur India.

Interestingly, in an earlier Mint interview, Ramdev said his rivalry was with multinational companies not the home-grown ones like Dabur. But a Patanjali spokesperson said that even if Dabur is an Indian company, it has no right to "loot" people. "Products are overpriced. Be it an Indian company or MNC, it should operate ethically, and products should be economical. With Patanjali, backed by Baba Ramdev's marketing, the market for Ayurvedic and herbal or natural products has expanded, which certainly is an opportunity for everyone," he said.

Dabur's competition in the domestic market in the last few years has increased as almost every packaged goods company-home-grown and multinational-has rolled out products that are herbal or natural. the trend has been triggered largely by Patanjali's success and opportunity the category offers for premiumization of products.

Herbal or Ayurvedic still constitutes a very small part of personal care in market in India. According to research report by UBS Securities in India, herbal products comprise 6-7% of the personal care products market, but the volume is growing at about "twice the segment average". The report estimated herbal to grow to about 10% of the segment by FY20 as the trend accelerates. Duggal, however, believes Dabur has the advantage of being a company that has been the "original" marketer of Ayurveda in India. There are differences between Ayurveda and herbal.

In my view point, Dabur trying to increase its business in foreign countries forgot to keep an eye out on its rivals in the domestic market and Patanjali did a lot of hurry to increase its portfolio and hence even after doing aggressive marketing and earning a lot of market share in the beginning failed to keep up the face as its focus was on lots of sectors. Therefore, both the companies should look at "Reliance Jio" and how wonderfully it focused on one particular business at the beginning and after making a mark in the market, it successfully attracted foreign investment from companies like Google, Facebook, Microsoft etc. At the same time it is also increasing its product and services' portfolio and bringing innovation in the Indian market which will boost the brand image and loyalty in the minds of the people and attract lots of new customers. All of these are based on proper management and if management is good enough even Patanjali can spread its business worldwide to compete against the world class and 'A' lister brands of the world and Dabur can also give tough fight both in the domestic as well as international market.

Comments

Post a Comment

I am always open for questions and if anyone has any doubt or suggestions,please let me know.